THERE HAVE BEEN LITERALLY hundreds of articles written about me and Diligent Board Member Services since 2007 — the year of Diligent’s IPO on the New Zealand stock exchange. The latest headlines use words like “NZX Darling.” Earlier headlines, which came when Diligent was trading at $.07 per share used words like “NZX Dog.” One thing is for sure, you have to be pretty thick-skinned to deal with the way in which the media describe things. And you soon learn not to get too puffed up when they praise you, or to care too much when they scathe you. For them, it’s all about selling that day’s newspaper because they know tomorrow that same newspaper is going to be wrapping someone’s fish and chips.

So, now with that said, I’m very thankful for the manner in which the global media have enabled my story, as well as Diligent’s, to be shared. And, I’ve learned to sort the chaff from the grain and to learn from the constructive criticisms that have been directed my way. In fact, there are several key articles that have helped shape my strategic thinking and are positive drivers for my team.

Of all the articles written, there are three that are absolute standouts for me.

* * * * * * * * * *

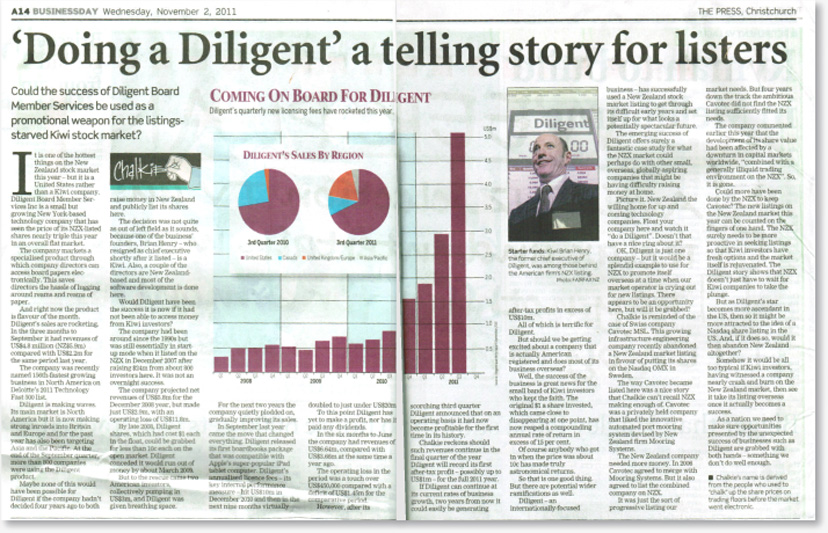

Article #1 — “Doing A Diligent” by David Hargreaves

The first article (pictured below) was written by David Hargreaves of Fairfax Media in November 2011. It’s titled, “‘Doing a Diligent’ a telling story for listers.” These are the key things he said:

1) “Diligent — an internationally focused business — has successfully used a New Zealand stock market listing to get through its difficult early years and set itself up for what looks a potentially spectacular future.”

2) “The emerging success of Diligent offers surely a fantastic case study for what the NZX market could perhaps do with other small, overseas, globally-aspiring companies that might be having difficulty raising money at home.”

3) “Picture it. New Zealand the willing home for up-and-coming technology companies. Float your company here and watch it ‘do a Diligent’. Doesn't that have a nice ring about it?”

4) “As a nation we need to make sure opportunities presented by the unexpected success of businesses such as Diligent are grabbed with both hands — something we don't do well enough.”

Article Credit: The PRESS Christchurch, New Zealand. Writer: "Chalkie" - Tim Hunter

* * * * * * * * * *

Article #2 — “Who Wants To Be An Internet Billionaire” by Brian Gaynor

The second article was written in February 2012 by Brian Gaynor, who is both a New Zealand Herald columnist and an Executive Director of Milford Asset Management (which is now one of Diligent’s largest shareholders). In this article, entitled, “Who wants to be an internet billionaire,” Brian makes the key observations:

1) “Facebook's IPO demonstrates that the world is changing rapidly and this presents great opportunities for New Zealand entrepreneurs. It shows that the value of a company can go from zero to US$100 billion in less than a decade and the world has no borders as far as internet-based companies are concerned.”

2) “It would be great to see an internet or SaaS-based company in the largest 10 listed NZX companies list as this would attract younger investors to the sharemarket and encourage entrepreneurs to focus on this sector.”

* * * * * * * * * *

Article #3 — “Going Public The Best Way, Says Drury” by Hamish Fletcher

The third article was written in October 2011 by Hamish Fletcher of the New Zealand Herald. In this article, entitled, “Going public the best way, says Drury,” Hamish discusses the strategy of Rod Drury taking his company public on the NZX “almost from day one.” The key points in the article are as follows:

1) Taking a company public to avoid the traditional funding rounds.

2) Building a long-term business from New Zealand.

Here’s what Rod Drury said on this topic: “We hope there are other companies that list and take a long-term view.” Drury said, “Going public is a way of drawing export dollars back into the local economy and ensuring intellectual property stays in New Zealand. It should be the aspiration of every New Zealand business person to take a company public at one point of their lives. If we want to create better schools and hospitals we have to create vehicles to make money [for New Zealand].”

* * * * * * * * * *

My Vision...

These three articles encapsulate my belief in the future for New Zealand in the global marketplace.

1) As pointed out by Hamish Fletcher, and as proven by both Xero and Diligent, what I have termed “capitalization before commercialization” via the New Zealand stock exchange can be a global competitive advantage for New Zealand.

2) As pointed out by David Hargreaves, “Doing A Diligent,” in other words, listing global software companies on the New Zealand stock exchange can also be a global competitive advantage for New Zealand.

3) As pointed out by Brian Gaynor, there are no borders and it is essential that we recognize that it is possible for NZX-listed, SaaS-based companies to attain multi-billion dollar valuations.

It should be noted that in my view, for this vision to be fulfilled, it is essential:

• That the New Zealand investment community recognizes the uniqueness, and competitiveness of the NZX, and the respect with which it is held in the global investment community.

• That the New Zealand investment community recognizes that global software companies have multiple options as to where they can list — for example, London, Toronto, Frankfurt, Sydney and Hong Kong are all actively competing for such listings.

• That the New Zealand Stock Exchange will work to make it simple for international investors to open brokerage accounts in New Zealand and to trade in New Zealand securities.